A successful survey begins with identifying what information your client needs to help make their investment decision, then using that knowledge to structure the survey to solicit necessary data points. This structure ensures respondents answer questions appropriately, you collect data you can trust, and your client receives reliable analysis.

Note: this is the first chapter in a series: "The Consultant's Guide to Diligence Surveys." Download the full guide here.

To do this effectively, you’ll need to answer the following questions before you begin authoring your survey:

- What data points are you looking to identify or confirm through this survey?

- What milestones will you need to reach to meet your client’s deadline?

- Who are you going to survey to acquire the data points you need?

- How are you going to structure your survey to get the right data?

Identifying Client Needs

Effective survey design should begin during project scoping. Your firm’s partner or project lead will typically determine research goals based on initial conversations with the client, which you can then use to outline a research plan.

Answers to the following questions will help you begin to identify who to survey and what to ask:

- What information would rule out an investment (i.e. deal killers)?

- What data points will significantly impact the investment’s financial projections (i.e. “model movers”)?

- What geographies need to be targeted?

- Who are the likely buyers or consumers of the company's products or services?

Building Respondent Profiles

After the scoping conversation, the first step in designing a due diligence survey is to identify the types of people you want to answer your questions.

Use the information from project scoping to define your respondent personas, adding as many relevant demographic (e.g. age, gender, geography) and firmographic (e.g. company name, company size, job title) filters as possible. The more defined you can make your persona, the better!

Crafting Quotas

Armed with information from your client scoping call and your respondent profiles, you’re ready to draft your respondent quotas.

Since sourcing respondents can take a significant amount of time (time that you’ll want to bake into your project timeline), we recommend you outline your quotas and share them with your panel providers ASAP. They can then work on sourcing respondents while you iron out your survey.

Like respondent profiles, the more specific you can be with your quotas, the better. This means sharing not just demographic requirements, but even desired answers to specific questions critical to your client’s research. You’ll receive higher-quality data and save on cost since you’ll only be paying for respondents useful to your research.

However, we’d be remiss if we didn’t mention a significant quota caveat: applying too many restrictions to your quotas can make it too difficult to source respondents within tight timelines. Actively communicate with your panel providers to monitor progress and always have a backup plan if you’re short on respondents with deadlines approaching.

For example, you could consider supplementing current users of a product with former users or expand your search from current employees in a specific industry to employees who’ve changed industries less than 6 months ago.

Well-written quotas might look like the following:

- 20 respondents working at companies with less than $1 million ARR.

- 30 respondents currently using product X.

- 30 respondents who are aware of product X but have never used it.

- 750 respondents using brands X, Y, and Z.

Defining the Timeline

Once you’ve defined your project’s personas and quotas, you’ll want to outline the full timeline of your survey, from authorship to close, to ensure it aligns with your client’s deadline. Two of the most important factors to keep in mind as you gauge the timeline for the survey are authoring and programming the survey as well as sourcing panel respondents.

Survey Programming and Authorship

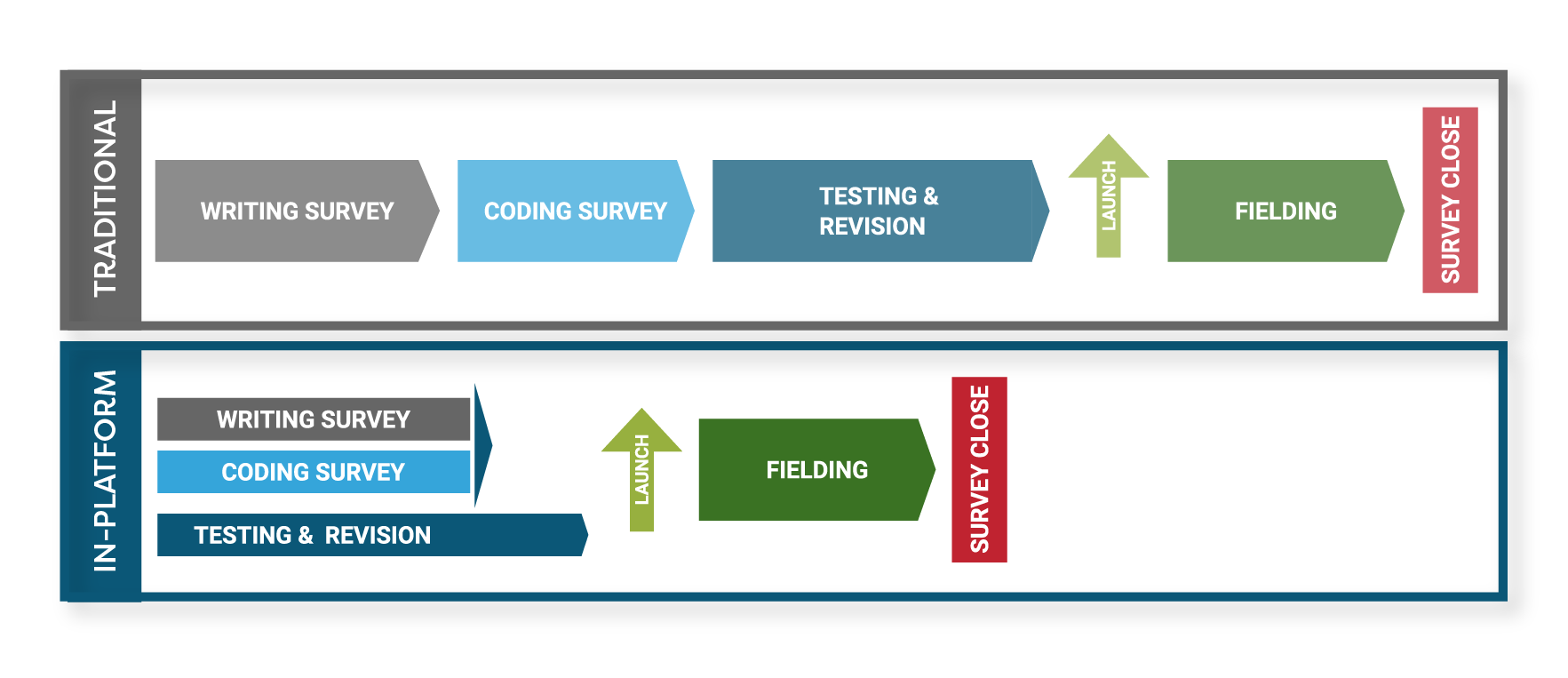

Many consulting teams author their surveys in Word because of their familiarity with the tool and the difficulty of using most survey platforms with multiple stakeholders across many iterations.

This workflow necessarily lengthens your timeline as authoring and programming are distinct steps, with the latter only able to begin after the former is complete. Combined with the last-minute content changes that are a part of any survey launch, keeping all aspects of the project aligned can quickly become a major headache.

Of course, if you opt for Inc-Query, you’ll be able to streamline this process by authoring directly on our platform, with the option to export a formatted Word document at any point for ease of sharing with stakeholders.

Sourcing Respondents

The time to source respondents varies depending on the personas you’ve defined. For example, consumer panels can generally be sourced very quickly, whereas B2B respondents may take days to find, particularly if you’re looking for respondents occupying senior leadership roles or with experience using very niche products. Adjust the time budgeted based on your respondent personas.

Developing Survey Paths

Another essential part of planning an effective survey is developing clearly defined survey paths - which questions certain respondents see, and in what order.

Simple surveys might include only one path, but your survey will likely include multiple paths for different personas. In this case, you should define each path clearly before authoring.

However, we recommend you limit your outline to no more than 5 paths. Outlining more than 5 paths risks delayed timelines due to the high volume of testing needed. For surveys that have such a high degree of variance, we recommend considering a second survey targeting a subset of your respondents.

Authoring the Screener

Once you’ve outlined your survey and respondents, you’ll need to create your screener. The screener is designed to:

- Screen every respondent to ensure they are qualified to take the survey.

- Assign respondents to a particular survey path.

In addition to ruling out unqualified candidates, most panel providers will not charge for respondents screened out early in the survey, providing budgetary and quality incentives to craft this section of the survey well.

Perhaps the most challenging aspect to writing an effective screener is disguising the qualifying answers, the subject of the next chapter.

How to Draft a Screener

A useful screener includes enough questions to segregate respondents, but not so many

questions as to risk user fatigue or abandonment. We recommend no more than 10-15

questions in total. If you’ve thoughtfully crafted your respondent profiles, authoring the

screener should simply be a matter of translating your demographic and firmographic

requirements into question form.

An often overlooked but equally important screener design practice is to sufficiently disguise questions so that qualifying answers are not obvious to the respondent. This ensures you pass only respondents truly qualified to take your survey rather than those just looking for a payout.

Some best practices for disguising your screening questions:

- Ask multiple choice questions with only one qualifying answer rather than binary (yes/no) questions.

- Make answers as uniform as possible, e.g. don't have qualifying answers be the wordiest.

- Check to ensure respondents have experience with the target and other relevant brands.

With the screener complete, you're ready to begin authoring your survey! Learn how to ask the right questions (and get quality responses) in Chapter 2.